Introduction

The real estate market is unique, imperfect, and susceptible to many external and internal influences. In particular, it provides living space and more, thus satisfying many types of needs. The housing segment is a very important part of the real estate market, mostly because it satisfies the livelihood and shelter needs. Residential premises (a flat) is a market product whose purchase can be financed with own funds or with external funds, usually in the form of a mortgage. The need for housing can be satisfied through purchase in the form of a sale-purchase transaction, but also by renting.

The situation on the housing market in Poland between 2019 and 2022 has been arousing great interest because there was a pandemic situation in that period, entailing restrictions that affected the behaviour of market players. Public sentiment has changed along with the uncertainty of the future, which influenced the attitudes of participants in the residential property market.

A period of destabilisation was observed from both the economic and social perspectives, with all market players forced to operate in new circumstances that affected both the demand and supply side of the housing market in Poland in various ways.

Material and methods

The purpose of the article is to present the situation on the housing market in provincial capitals of Poland between 2019 and 2021. The research focuses on the phenomena that occurred in each quarter of the 2019-2021 period, i.e. just before the pandemic, during the restrictive phase of the pandemic and immediately after. The number of transactions made, average unit prices and rent rates for flats on the secondary market were examined for individual quarters of each year. In order to illustrate the situation of the housing market in Poland, the analysis covered data referring to 16 provincial capitals, i.e. Gdansk, Krakow, Poznań, Wrocław, Białystok, Bydgoszcz, Katowice, Kielce, Lublin, Łódź, Olsztyn, Opole, Rzeszów, Szczecin, Zielona Góra and Warszawa. The empirical data comes mostly from annual reports from the situation on the housing and commercial property market in Poland compiled by the National Bank of Poland in 2019, 2020 and 2021 and from the Central Statistical Office.

The research methodology was based on statistical methods, in particular, changes of unit prices and housing rental rates over time were analysed, as well as the number of purchase and sale transactions carried out during the analysed period.

Research results

Housing market in Poland between 2019 and 2022

It is generally known that the demand on the real estate market results from the interactions between two basic factors: the needs and the purchasing power. In turn, the supply results from the interaction of the structure of the existing stock and new substance growth, which is in some way limited and requires a long time. In the short term, the supply can change irrespectively of the changes of resources because it responds to changes in economic activity and in consumer spending, it depends mostly on the resources in the longer term though.

According to the data, the interest in residential properties was strong in Poland’s provincial capitals in 2019. Such demand can be a consequence of the stable economic growth and a low cost of money, as well as a good situation on the labour market. Property was purchased mainly with the buyers’ own funds although the number of loans taken out was increasing, as confirmed by studies by other authors (Liu, Su, 2021). In this situation, investment demand became increasingly important as flats were mainly purchased for rent. The economic conditions were favourable in 2019 even though the GDP was very slightly lower, the economic growth reached 4%. This was accompanied by favourable credit conditions and low interest rates on bank deposits. Flats were bought both to satisfy the buyers’ own needs and for investment purposes. This trend could be observed in each of the analysed cities, with a particularly high number of transactions in large cities, i.e. the capitals of Poland’s voivodeships: Warszawa, Krakow, Wrocław and Poznań.

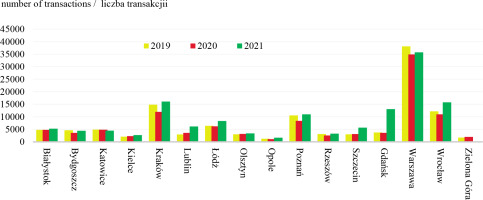

The demand for housing remained stable when the Polish property market faced restrictions related to the pandemic in 2020. During the first months of the lockdown, many Poles had to postpone their housing plans and there was a noticeable drop in interest in real estate purchase. Observations of the Polish real estate market show that the pandemic had an adversely effect on purchases of residential units for rent, while the situation remained unchanged for the buyers buying to satisfy their own needs. March 2020 saw the highest number of flats completed on a quarterly basis. The first restrictions on professional and private life were introduced for the whole population at the same time, to the point of a total lockdown that few expected. Most forecasts were pessimistic at the beginning of the pandemic and the total lockdown caused many people to hold back on investments; many transactions were frozen or significantly delayed due to the restrictions on movement (Najbar, 2021). When analysing the data, it is important to note that the housing situation varied in local markets (Li, Zhang, 2021). Figure 1 shows the number of completed residential sales transactions in the provincial capitals of Poland from 2019 to 2021. The data shows that the majority of transactions were completed in 2019 and 2021 with a clear downward trend in 2020.

Fig. 1

The number of residential purchase and sale transactions in provincial capitals of Poland between 2019 and 2021

Data source: based on annual reports on the situation of the residential and commercial real estate market in Poland compiled by the NBP in 2019, 2020 and 2021, and on the GUS data.

The first two months of 2020 saw record mortgage sales (Czech et al., 2020). According to the Loan Information Office (BIK), the total value of loans granted was 26% higher in that period than the year before. The epidemic situation in Poland has turned the credit market upside down. All the more so as the Monetary Policy Council cut interest rates and loan instalments shrank but banks, fearing hard times, were quick to tighten mortgage procedures. A much more thorough analysis of a potential borrower’s creditworthiness began (Bolesta, Sobik, 2020). In addition, many lending institutions decided to increase the required own contribution despite the fact that the Polish Financial Supervision Authority did not issue any new recommendations on the matter.

Some banks reduced the amount of the required own contribution in the 3rd quarter of 2020 and even admitted those employed under civil law contracts as borrowers. The uncertain economic situation and the pandemic-induced sentiment curbed demand, which was particularly evident in the second quarter of 2020 when the number of housing transactions fell rapidly, but the situation had already started to improve by the fourth quarter of 2020. Indeed, the provincial capitals of Poland saw high housing sales in 2021. The research shows that there was particular interest in the housing located in leading Polish cities. The majority of transactions completed in 2021 took place in the capital of the country (Warszawa 35.740) and four other large cities, i.e. Krakow (16.124), Wrocław (15.800), Gdańsk (13.084) and Poznan (11.014). In contrast, the fewest transactions took place in Opole (1.693), Bydgoszcz (2.413) and Kielce (2.493). The varying number of residential sales transactions carried out in each city confirms that these were transactions on the local market.

Unit prices of residential units in Polish pro- vincial capital cities in individual quarters of 2021 and 2022

Real estate prices are the external expression of value, usually refer to the selling or transaction prices and are related to the exchange, i.e. they are the fait accompli. They present the amount that a specific buyer agrees to pay and a specific seller agrees to accept the terms of a transaction. The literature on the subject indicates that the main factors influencing housing prices are the supply of housing, the availability and cost of credit, population income, inflation, prices of building materials and construction services, and the price of land for development.

According to the data, the 2019 property market was more active, with increased demand in the residential and commercial sectors. This changed with the outbreak of the pandemic in March 2020, when average unit prices of flats increased across Poland. Table 1 presents average unit prices of residential units (in PLN) in Polish provincial capital cities in individual quarters of 2019-2021.

Tab. 1

Average unit prices of residential units (in PLN) in Polish provincial capital cities in individual quarters of 2021-2022

The research shows that the highest average unit prices for flats were recorded particularly in the fourth quarter of 2019: in Warsaw (PLN 9.812), Gdańsk (PLN 8.364), Wrocław (7.316) and Krakow (PLN 7.657), while the lowest such prices were recorded in Kielce (PLN 4.453) and Zielona Góra (PLN 4.547). Average unit prices of flats in Poland’s provincial capitals showed an upward trend in 2020 and 2021. In all quarters of these years, average transaction prices for residential units increased by between 8.3% and 14.7% year- on-year. The prices also demonstrated an upward trend in all the capital cities analysed in 2021, with price dynamics accelerating towards the end of the year and even reaching double-digit figures in the 4th quarter.

According to the GUS data, average unit prices of residential units were increasing faster than average prices in the economy. The comparison of average unit prices in the first quarters of 2021, 2020 and 2019 showed an increase between 10% and 40%. The highest unit prices, even up to double-digit figures, could be observed in the 4th quarter of 2021, in two cities in Poland, i.e. Warsaw (PLN 11.444) and Gdańsk (PLN 11.128), while the lowest prices (below PLN 6.000) were reported in Kielce, Opole and Zielona Góra. It is worth noting that the purchase of a square metre of a flat in the capital city of Poland is on average more expensive by more than PLN 500 than in Kielce, and the same situation can be observed in all quarters of the years under review.

Residential rental rates in Polish provin- cial capital cities in individual quarters of 2019-2021

Despite the fiscal and monetary interventions that helped avoid an economic collapse, the Polish real estate sector faced pandemic-related restrictions and the short-term and long-term rental segments of the market suffered the most. Unique conditions, i.e. the lockdown, lack of special events, uncertainty in holiday planning, etc. have affected the short-term rental market (Gabryjończyk, Gabryjończyk, 2021). Some owners of flats as well as some hotels and guesthouses started to save itself with medium- term rentals, i.e. for 1-3 months. In a situation that made it difficult to plan and work in a longer- perspective, this solution allowed many owners of flats to wait out the difficulties. In addition, the lack of students and remote work arrangements diminished the interest in rentals and rental rates (Rybka et al., 2021). It was difficult to find takers for longer leases but the market began to thaw slowly in spring 2020. Table 2 presents average rental rates per square metre of a residential unit in Polish provincial capital cities in individual quarters of 2019-2021.

Tab. 2

Average rental rates per square metre (in PLN) of a residential unit in Polish provincial capital cities in individual quar- ters of 2019-2021

The research shows that the residential rental market was expanding over the 2019- 2021 period, with an upward trend in average residential rental rates observed in all the analysed provincial capitals. A temporary drop in rental rates in most of the analysed cities can only be seen in 2020 (the restrictive period of the pandemic). The growth rate of rental rates was positive on the local markets in most provincial capitals. The situation was certainly related to the rising cost of credit, which reduced the capacity to purchase flats and stimulated the rental market; it was also related to seasonal demand, e.g. from students returning to university (Bryk, 2019).

Average residential rental rates increased even up to 12.6% year-on-year in the majority of local markets. This was a catalyst for the more affluent population to purchase rental housing for investment purposes. Average rental rates dropped in the subsequent quarters of 2020 and only became stable in the 4th quarter of the year. The slowdown in tenant activity was not permanent because, with the loosening of restrictions, interest in renting increased again. The highest unit rental rates for residential units were observed in the 4th quarter of 2021 in Gdańsk (PLN 54.20), Warsaw (PLN 52.70) and Wrocław (PLN 50.40), and were significantly higher than in other locations. The lowest approximate rental rates of the analysed period depended on the quarter and were reported in Olsztyn (PLN 31.20) and Kielce (PLN 29). The research shows that the residential rental market in Poland’s largest cities is characterised by a discernible division of cities into the following price groups: Gdańsk, Warszawa and Wrocław with unit rates exceeding PLN 50, Kraków, Poznań and Szczecin with rates exceeding PLN 40 and other cities with rates ranging from PLN 29 to PLN 39.50. In almost all of the analysed cities, rental prices for residential units showed similar trends with a marked increase in rates, particularly towards the end of 2021.

Conclusions

The research shows a large spatial variation in the number of completed transactions, unit prices and rental rates for residential units in Poland’s provincial capitals in each quarter between 2019 and 2022.

The most attractive locations among the analysed 16 provincial capital cities of Poland were Kraków, Gdańsk, Warszawa, Wrocław and Poznań. They are the largest Polish city agglomerations which, by creating favourable living conditions, meet the expectations of residents in terms of the labour market, wages, housing and social infrastructure.

In particular, the attractiveness of these local markets is demonstrated by the presented data, showing effective demand, high housing prices and high residential rental rates.

Between 2019 and 2022, most transactions took place in 2019 and 2021 with a clear downward trend in 2020, which indicates the impact of the pandemic on the attitudes of players on the property market.

An upward trend in housing unit prices and rental rates was observed in all the analysed cities, with a noticeable temporary decrease in rental rates in 2020 as the short- and long-term rental market segment was most affected by the pandemic. Average rental rates dropped in many provincial capital cities while national average rates continued to rise (they were higher by 2.1% in January 2021 than a year earlier).

The conclusion based on the conducted research is that the housing market in the provincial capitals of Poland has successfully weathered the crisis of the pandemic. Even though a decrease in the number of transactions and lower rental rates can be observed in certain quarters of 2020, average housing unit rates demonstrated an upward trend between 2019 and 2022. This only confirms that residential real estate is perceived as a relatively safe investment of capital, which has so far yielded higher rates of return compared to investing cash in safer assets such as Treasury bonds or bank deposits. Capital holders faced with the situation, including inflation and the unprofitability of depositing money in banks or bonds, looked for alternatives in the property market.