Wstęp

Proces cyfryzacji gospodarki i społeczeństwa w wymiarze globalnym należy do najbardziej dynamicznych zmian, które nastąpiły w ostatnich latach. Otwierają one nowe możliwości w tworzeniu modeli biznesowych oraz dotyczą rozwoju wielu branż i dziedzin życia. W obecnym czasie na całym świecie zauważalny jest rozwój technologii cyfrowych, które mają znaczenie w przypadku usług e-commerce. Rosnące znaczenie handlu elektronicznego jest odpowiedzią na wyzwania współczesnego świata oraz zwiększające się zapotrzebowanie konsumentów w aspekcie szybkości i różnorodności dokonywania zakupów (Pieniak-Lendzion, Stefaniak, 2018). Według Światowej Organizacji Handlu (WTO) pojęcie e-commerce oznacza produkcję, działania reklamowe, sprzedaż oraz dystrybucję produktów z zastosowaniem sieci teleinformatycznych (Drobiazgiewicz, 2011). E--commerce (nazywany handlem elektronicznym) to proces sprzedawania i kupowania produktów lub usług. Polega on na zawieraniu transakcji handlowych za pomocą środków elektronicznych, dzięki dostępowi do Internetu. W procesie tym, pomocne są również narzędzia tradycyjne, takie jak komputer lub telefon. Na płaszczyznę elektroniczną przeniesiony jest cały przebieg prezentacji ofert oraz ich wyboru, przyjmowania i składania zamówień, zawieranie kontraktów z ich obsługą powiązaną z przetwarzaniem dokumentów, a także dokonywanie płatności (Gregor, Stawiszyński, 2002).

Przyjąć można zatem, że e-commerce jest procesem zawierania transakcji handlowych przez Internet. Wykorzystuje się tym celu potrzebne narzędzia lub środki (Skorupska, 2023). Zauważyć również należy, że dzięki rozwojowi technologii cyfrowych w zakresie bankowości, zwiększyła się liczba jej użytkowników. Płatności za zakupy on-line można dokonywać za pośrednictwem Internetu, w dowolnym miejscu i czasie, przy wykorzystaniu urządzeń mobilnych takich jak laptop, tablet lub smartfon. Celem artykułu jest analiza wpływu płatności cyfrowych na rozwój branży e-commerce w Polsce, a także a także zbadanie geograficznych różnic w dominujących metodach płatności oraz wpływu regulacji finansowych na tempo i charakter adopcji innowacji płatniczych, ze szczególnym uwzględnieniem roli płatności natychmiastowych i mobilnych w różnych systemach gospodarczych.

Branża e-commerce w Polsce

Początek branży e-commerce w Polsce sięga końca XX wieku. W tym czasie przybyło wiele sklepów internetowych, zaś znaczny wzrost ich liczby odnotowano po 2020 roku. Wpływ na ten stan rzeczy miały ograniczenia dostępu do zakupów w sklepach stacjonarnych z powodu pandemii Covid-19. W wyniku restrykcji, które były nałożone w celu ograniczenia rozprzestrzeniania się choroby, handel internetowy mocno zyskał i zauważyć można jego znaczny rozwój. Sklepy stacjonarne niejednokrotnie podejmowały strategiczne decyzje o przeniesieniu swojej działalności do sieci, uruchamiając własne e-sklepy i platformy handlowe (Stefaniak, Ojdana-Kościuszko, 2021).

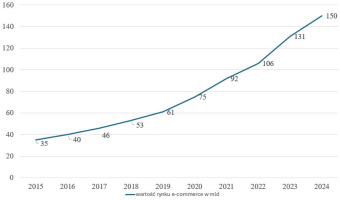

Według raportu E-commerce wydanym przez Gemius, w Polsce w 2024 roku liczba internautów wynosiła około 30 mln osób w wieku od 7 do 75 lat, z czego około 78% dokonało w przeszłości zakupów przez Internet. W polskich e-sklepach kupuje około 75% internautów, zaś w zagranicznych około 36%, natomiast około 19% internautów dokonuje zakupów za pośrednictwem social mediów (Gemius, 2025). Światowa sprzedaż za pośrednictwem Internetu w 2024 roku osiągnęła wartość około 5,8 biliona dolarów, zaś prognozy dotyczące 2027 roku, wskazują na wzrost wartości tego typu handlu do ponad 8 bilionów dolarów. W Polsce wartość branży e-commerce w 2024 roku osiągnęła około 150 miliardów złotych. Według podawanych prognoz, do 2028 roku wartość ta może wynieść nawet 92 miliardy złotych. Może to oznaczać, że średni roczny wzrost branży e-commerce, będzie wynosił około 8% (Szczepaniak, 2025). Na rycinie 1 przedstawiono wykres trendu wartości rynku e-commerce w Polsce w mld w latach 2015-2024.

Rycina 1

Wykres trendu wartości rynku e-commerce w Polsce w mld w latach 2015-2024

Źródło: Gemius. (2025). E-commerce w Polsce 2024.

Wartość rynku e-commerce: Rynek e-commerce w Polsce wykazuje dynamiczny wzrost, z wartością rosnącą z 35 mld zł w 2015 roku do 150 mld zł w 2024 roku, co daje średnie roczne tempo wzrostu na poziomie 17,4%. Największe przyspieszenie w wartościach rynku nastąpiło w 2020-2021, czyli w okresie pandemii COVID-19 (wzrost do około 123% rok do roku). W latach poza pandemicznych tempo wzrostu było umiarkowane (około 114-115%). Na rycinie 2 przedstawiono wykres trendu liczby użytkowników bankowości mobilnej w Polsce w mln w latach 2015-2024.

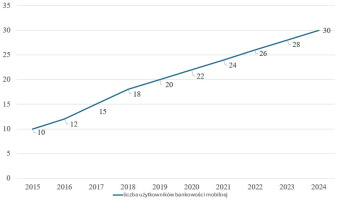

Rycina 2

Wykres trendu liczby użytkowników bankowości mobilnej w Polsce w mln w latach 2015-2024

Źródło: Związek Banków Polskich. (2025). NetB@nk II kwartał 2025.

Dokonując analizy danych zawartych na rycinie 2, można zauważyć, że liczba użytkowników bankowości mobilnej wzrosła z 10 mln w 2015 roku do 30 mln w 2024 roku, co daje średnie roczne tempo wzrostu na poziomie 12,4%. Tempo wzrostu w analizowanym okresie było stałe, ale widać stabilne przyspieszenie w latach 2017-2021. Na rycinie 3 przedstawiono udział metod płatności w e--commerce w % w Polsce w latach 2015-2024.

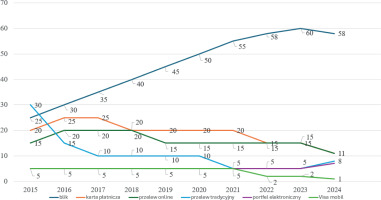

Rycina 3

Udział metod płatności w e-commerce w % w Polsce w latach 2015-2024

Źródło: Commercetrends. (2024). Jak Polacy płacą online? Metody płatności pod lupą – raport 2024/2025.

Analizując dane zawarte na rycinie 3, można zauważyć, że BLIK zdominował rynek płatności online, osiągając 58% udziału w 2024 roku, podczas gdy tradycyjne metody, takie jak przelewy tradycyjne, straciły na popularności. Zauważyć można również szybki wzrost udziału BLIK w tym okresie, z lekkim spadkiem w 2024 r.

W ostatnich latach e-commerce odgrywa znaczącą rolę w ogólnym handlu detalicznym w Polsce. Zaś rozwój tej branży stanowi ważny czynnik, który może wpłynąć na wzrost polskiej cyfryzacji. Efektem tego stanu rzeczy jest między innymi konieczność podnoszenia kompetencji cyfrowych Polaków, a także inwestowanie w infrastrukturę cyfrową zaspokajającą potrzeby zakupowe konsumentów (Krajowa Izba Gospodarcza, 2024).

Płatności cyfrowe

Płatności cyfrowe polegają w głównej mierze na wymianie środków finansowych w elektroniczny sposób. Zazwyczaj do tego celu wykorzystywane są urządzenia mobilne lub kanały cyfrowe. Płatności cyfrowych można dokonywać również przy użyciu karty płatniczej. Tego typu płatności powodują wzrost gospodarczy kraju, gdyż w ten sposób każdy człowiek ma zapewniony dostęp do usług bankowych, a tym samym może on stymulować wydatki związane między innymi z handlem internetowym, w tym międzynarodowym (Europejski Trybunał Obrachunkowy, 2025).

W literaturze przedmiotu można odnaleźć pokrewne terminy dotyczące płatności cyfrowych, do których zaliczyć można płatności elektroniczne (e-płatności) oraz mobilne płatności (m-płatności). Płatności elektroniczne, są dokonywane za pośrednictwem Internetu. Stanowią one takie operacje finansowe, które dokonywane są na odległość. Do tego celu wykorzystywane są urządzenia elektroniczne takie jak komputer, tablet lub telefon. Kanałami takich transakcji może być polecenie przelewu lub karta płatnicza, natomiast mogą być one dokonywane za pośrednictwem dostawców płatności elektronicznych. Płatności elektroniczne są ściśle związane z handlem internetowym (Chinowski, 2013). Płatności mobilne oznaczają również płatności, które dokonywane są za pomocą mobilnych urządzeń, do których zaliczyć można telefon komórkowy, laptop lub palmtop. Urządzenia te mają za zadanie umożliwiać łączność z siecią telekomunikacyjną w celu dokonania płatności (Cicharska, 2015). Można zatem stwierdzić, że m-płatność jest dokonywana przy użyciu urządzenia przenośnego (Borcuch, 2020).

Powstanie i rozwój płatności cyfrowych ma swój początek wraz z powstaniem i rozwojem e--commerce. E-płatności są znacznie lepiej przystosowane do wymagań e-handlu niż na przykład karty płatnicze czy tradycyjne przelewy bankowe, których koncepcje tworzone, a następnie wprowadzane były jeszcze przed powszechnym dostępem do Internetu. Porównując cyfrowe systemy płatnicze, zauważyć można, że w większości przypadków nie zauważa się praktycznie żadnej różnicy między elektroniczną płatnością krajową a zagraniczną. Dodatkowo e-płatności są znacznie tań-szym rozwiązaniem w porównaniu do tradycyjnych zagranicznych przelewów bankowych. Zagraniczny przelew bankowy często obciążany jest przez banki wysoką prowizją, a kolejnym elementem stanowiącym pewnego rodzaju barierę, staje się potrzeba dokonania przewalutowania po niestety nie zawsze korzystnych dla klienta obowiązujących kursach walut. E-commerce w Polsce ma szansę w najbliższym czasie stać się jednym z najbardziej zaawansowanych w Europie, a nawet na świecie (Chinowski, 2013). W tabeli 1 przedstawiono opis korzyści z wykorzystania płatności cyfrowych w e-commerce.

Tabela 1

Korzyści z wykorzystania płatności cyfrowych w e-commerce

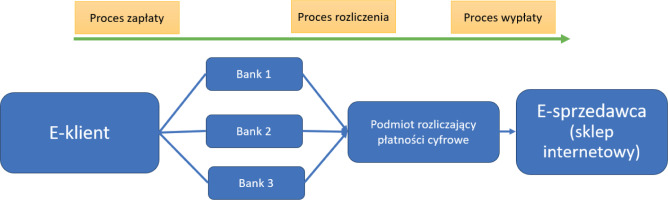

Z punktu widzenia sprzedawcy zaletą cyfrowych płatności może być wysokość prowizji, która jest niższa niż w przypadku transakcji zawieranych za pomocą innych form, na przykład kart płatniczych. Na rynku elektronicznych płatności występuje duża konkurencja między dostawcami usług płatniczych Dzięki takiej sytuacji podmioty będące dostawcami usług płatniczych rywalizują między sobą i oferują sklepom internetowym korzystającym z ich systemów optymalniejsze warunki handlowe. Zatem, zauważyć można, że liczba zastosowań płatności elektronicznych wzrasta, a ich technologia stale się rozwija w porównaniu do tradycyjnych metod płatności. Jednym z przykładów szybkiego rozwoju płatności cyfrowych i stagnacji tradycyjnych metod płatności mogą być płatności transgraniczne. Działanie jak również podstawowy proces płatności cyfrowej, stosowany między innymi w tzw. szybkich przelewach internetowych, które można przedstawić w trzech krokach procesowych (Chinowski, 2013):

Klient po dokonaniu zakupu w sklepie internetowym i wybraniu odpowiedniej metody płatności jest przenoszony na stronę internetową swojego banku. Po zalogowaniu się na swoje konto bankowe, czeka na klienta wypełniony już wniosek przelewu na rzecz sprzedawcy. Następnie zobowiązany jest on do dokonania autoryzacji przelewu.

Po wykonaniu czynności autoryzacji, klient przenoszony jest z powrotem na stronę internetową sprzedawcy, który w tym samym czasie dostaje od dostawcy płatności informację o dokonaniu zapłaty przez klienta.

Następnie dostawca płatności otrzymuje przelew z banku klienta i przekazuje te środki na rachunek bankowy sprzedawcy. Może być również taka sytuacja, że sprzedawca otrzymuje przelew bezpośrednio z banku klienta.

Proces płatności nie jest skomplikowany i trwa przez bardzo krótki czas, na przykład przez zaledwie chwilę. Schemat płatności cyfrowych przedstawiono na rycinie 4.

Rycina 4

Schemat płatności cyfrowych

Źródło: opracowanie własne na podstawie: B. Chinowski, Elektroniczne metody płatności. Istota, rozwój, prognoza, Poradnik klienta usług finansowych, s. 9.

W obecnym czasie w Polsce dostępny jest pełen wachlarz systemów płatności cyfrowych, które obsługują branżę e-commerce. E-klienci mogą korzystać począwszy od tradycyjnych przelewów internetowych, następnie mogą płacić za pomocą kart płatniczych, a także mogą wykorzystywać nowoczesne rozwiązania mobilne i portfele elektroniczne. Dzięki rozwojowi technologii związanych z płatnościami cyfrowymi, dostępne są na runku coraz to nowsze i bardziej innowacyjne metody e-płatności. Wymienione rozwiązania, związane z e-płatnościami zwiększają komfort dokonywania transakcji internetowych (Brodowska-Szewczuk, 2024).

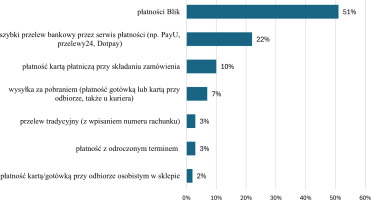

W obecnym czasie w Polsce wśród klientów online1 największą popularnością cieszy się metoda płatności cyfrowych BLIK, a następnie trochę rzadziej stosowane są szybkie przelewy bankowe takie jak: Przelewy24, PayU i Dotpay. Mniej popularne są płatności mobilne, które dokonywane są za pośrednictwem kodów QR lub też płatności rozkładane na raty. Najmniej popularne metody płatności to płatność kartą lub gotówką przy odbiorze osobistym w sklepie (Gemius, 2025). Na rycinie 5 przedstawiono formy płatności wykorzystywane najczęściej do zakupów przez Internet w Polsce w 2024 roku.

Rycina 5

Formy płatności wykorzystywane najczęściej do zakupów przez Internet w Polsce w 2024 roku

Źródło: Gemius. (2025). E-commerce w Polsce 2024.

Na rozwój płatności cyfrowych wykorzystywanych w e-commerce może mieć wpływ segmentacja klientów. W tabeli 2 przedstawiono segmentację konsumentów e-commerce w Polsce.

Tabela 2

Segmentacja konsumentów e-commerce w Polsce

[i] Źródło: opracowanie własne na podstawie: Gemius. (2025). E-commerce w Polsce 2024. Przelewy24. (2024). Raport e-commerce 2024 - Polska.

Zatem zauważyć można, że młodsze osoby i mieszkańcy dużych miast częściej korzystają z BLIK, portfeli cyfrowych i płatności odroczonych. Starsi i mieszkańcy mniejszych miejscowości preferują przelewy tradycyjne i płatność przy odbiorze. Ważnym aspektem w rozwoju płatności cyfrowych jest także mentalność i sposób myślenia kupujących. Jeszcze do niedawna konsumenci woleli zapłacić za nabyte w sklepie internetowym dobra na przykład kurierowi gotówką przy odbiorze. W ostatnich latach trend sposobu płatności zmienił się, ze względu na wzrost bezpieczeństwa zakupów online, a tym samym wzrost bezpieczeństwa płatności cyfrowych. Efektem tego stanu, jest fakt, że na polskim rynku płatności cyfrowych można z roku na rok odnaleźć coraz nowsze metody płatności (Izba Gospodarki Elektronicznej, 2024). W tabeli 3 przedstawiono najczęściej wykorzystywane metody płatności w e-commerce w Polsce.

Tabela 3

Najczęściej wykorzystywane metody płatności w e-commerce w Polsce

Rozwój płatności cyfrowych w aspekcie e-commerce

Płatności cyfrowe są niezwykle istotne dla rozwoju e-commerce. W ostatnich latach zauwa-żalny był prawdziwy rozwój innowacji w tej sferze. Nowoczesne metody płatności online znacznie ułatwiają klientom zakupy w sieci, a jednocześnie przyczyniają się do zwiększenia konwersji oraz przychodów sklepów internetowych. Płatności cyfrowe w Polsce istnieją od lat dziewięćdziesiątych XX wieku, kiedy to pojawiły się pierwsze sklepy internetowe. Jednak prawdziwy przełom w tej dziedzinie miał miejsce dopiero w ostatniej dekadzie. Wzrost handlu elektronicznego oraz rosnące zapotrzebowanie konsumentów na wygodne metody płatności za zakupy w sieci były kluczowymi czynnikami w tym procesie. Obecnie płatności cyfrowe stanowią nieodłączny element e-commerce. Z prognoz platformy Statista wynika, że globalny rynek płatności cyfrowych ma wzrosnąć o 9,52% w latach 2024-2028, osiągając wartość 16,62 biliona USD w 2028 roku. To oznacza fakt, że istotnym elementem jest możliwość dokonywania płatności przez Internet w handlu elektronicznym. Można z pełnym przekonaniem stwierdzić, że rozwój e-commerce nie byłby możliwy bez nowoczesnych, wygodnych i bezpiecznych form płatności online. To właśnie te metody w znacznym stopniu przyczyniają się do dalszego wzrostu popularności zakupów w Internecie (Kaźmierczak, 2024).

Kolejnym czynnikiem napędzającym rozwój płatności cyfrowych był okres pandemiczny. Mimo swoich negatywnych skutków, okazał się on być przełomowy dla polskiego e-commerce. Stopniowe odmrażanie gospodarki oraz wprowadzenie kolejnych ograniczeń nie wpłynęły na rezygnację z zakupów online. Wręcz przeciwnie, wiele osób stało się bardziej świadomych korzystania z e-commerce, co przyczyniło się do dalszego rozwoju tego segmentu rynku. Zakupy w sieci zyskały na popularności, a konsumenci przyzwyczaili się do korzystania z internetowych platform zakupowych. Urządzenia mobilne, takie jak smartfony i tablety, stały się popularnym narzędziem do dokonywania zakupów. Wśród metod płatności w e-commerce, BLIK oraz Pay-By-Linki zajmują pierwsze miejsce w zakupach przez smartfony. Dodatkowym atutem jest fakt, że coraz więcej Polaków decyduje się na zakupy w zagranicznych sklepach internetowych. Na ten stan rzeczy może mieć wpływ rosnąca popularność aplikacji takich jak Revolut, PayPal czy Aion Bank, które oferują możliwość przewalutowania środków finansowych podczas transakcji. Aplikacje te umożliwiają łatwiejsze zakupy w obcych walutach bez potrzeby otwierania tradycyjnego konta walutowego w banku. Takie rozwiązania sprawiają, że zakupy zagraniczne stają się bardziej dostępne i wygodne dla konsumentów (Izba Gospodarki Elektronicznej, 2020).

Nowoczesne technologie płatnicze oparte są o wygodę, szybkość i bezpieczeństwo, a te zalety zakupów online występują już jako standard podczas całego procesu zakupowego. W przyszłości klienci mogą oczekiwać, że będą one jeszcze bardziej spersonalizowane, a granice między zakupami online a offline będą się zacierać. To stworzy zintegrowane, płynne doświadczenia, które będą dostosowane do indywidualnych potrzeb konsumentów. W aspekcie rozwoju technologii w zakresie płatności cyfrowych ważnym elementem jest możliwość zastosowania technologii biometrycznych, takich jak rozpoznawanie twarzy czy odcisków palców. Pozwala to na szybkie i bezpieczne autoryzowanie transakcji, co eliminuje konieczność podawania na przykład numeru karty lub wprowadzania haseł. Dzięki tym innowacjom płatności cyfrowe stają się łatwiejsze i bardziej dostępne dla użytkowników (Nowy Outsourcing, 2025).

W Polsce został już wprowadzony na rynek płatności cyfrowych jeden z pierwszych systemów płatniczych opartych na biometrii tęczówki oka – PayEye. Zaczyna on być dostępny także w sklepach stacjonarnych. Biometria, w tym skanowanie twarzy i linii papilarnych, staje się coraz bardziej powszechna, a nowe regulacje wprowadzone przez Unię Europejską mogą wpłynąć na sposób weryfikacji tożsamości podczas płatności. Jednakże, metody płatnicze, które wymagają ingerencji w cia-ło, takie jak implanty NFC, czyli niewielkie urządzenia wszczepiane pod skórę, które wykorzystują technologię komunikacji bliskiego zasięgu i umożliwiają realizację płatności zbliżeniowych, przechowywanie informacji, a w przyszłości mogą również pełnić funkcję identyfikatorów lub kluczy dostępu, są mniej akceptowane przez Polaków i mogą zyskać popularność jedynie wśród entuzjastów nowych technologii. W praktyce biometria staje się częścią codziennych transakcji, co przyczynia się do rosnącej akceptacji nowoczesnych technologii w płatnościach cyfrowych (Izba Gospodarki Elektronicznej, 2020).

Przyszłość zakupów opierać się będzie na technologii, która ułatwi proces zakupowy, zapewniając większą wygodę, bezpieczeństwo oraz dostosowanie do indywidualnych potrzeb użytkowników. Niezależnie od tego, czy mówimy o płatnościach cyfrowych, mobilnych, biometrycznych, czy zakupach w wirtualnym świecie, to, co kiedyś wydawało się tylko wizją, obecnie staje się coraz bardziej codziennością. Konsumenci zyskują większą kontrolę nad swoimi finansami, a sprzedawcy mogą lepiej odpowiadać na oczekiwania swoich klientów, tworząc jeszcze bardziej zindywidualizowane, płynne i bezpieczne doświadczenia zakupowe (Nowy Outsourcing, 2025).

Przegląd porównawczy płatności cyfrowych w wybranych krajach świata

W krajach Unii Europejskiej, w których wprowadzona została strefa euro, gotówka wciąż dominuje w liczbie transakcji (około 52%), ale wolumenowo przeważają karty płatnicze (56%). Płatności natychmiastowe SEPA Instant rozwijają się, a mobilne portfele (Apple / Google Pay) rosną (Canepa, 2024). W Polsce dokonuje się około 98% transakcji kartowych zbliżeniowo, zaś BLIK jest najbardziej popularnym systemem płatności mobilnych (Payment Systems Department, 2025). W Stanach Zjednoczonych dominują karty kredytowe/debetowe, natomiast płatności natychmiastowe (FedNow, Zelle), które stosowane są w codziennych transakcjach, rozwijają się wolniej niż w innych krajach i regionach (Financial Times, 2024). Chiński rynek płatności cyfrowych jest najbardziej zdominowany przez portfele mobilne. Ponad 4 na 5 dorosłych w tym kraju używa właśnie tego rodzaju płatności, a Alipay / WeChat Pay osiągają łącznie ponad 90% rynku m-płatności (GlobalData, 2024). Zaś w Indiach i Brazyli w lipcu 2025 roku dominowały niskokosztowe płatności natychmiastowe UPI – około 19,5 mld transakcji miesięcznie, a z Pix korzystało około 76% populacji użytkowników (Banco Central do Brazil, 2025). W tabeli 4 przestawiono porównanie rynków płatności cyfrowych w Polsce i wybranych krajach świata.

Tabela 4

Porównanie rynków płatności cyfrowych w Polsce i wybranych krajach świata

[i] Źródło: opracowanie własne na podstawie: European Central Bank. (2023). Payments statistics: first half of 2023. DeNiderlandsche-Bank. (2025). Cash remains a key payment method in Europe, but its share continues to decline. Canepa, F. (2024). Even in the euro zone, king cash is about to lose its throne.

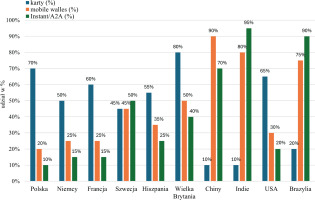

Porównanie poziomu adopcji dominujących metod płatności w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich przedstawiono na rycinie 6. Zestawienie uwzględnia główne instrumenty płatnicze, takie jak karty, portfele mobilne oraz systemy płatności natychmiastowych (A2A), a także wskazuje na charakterystyczne trendy w cyfryzacji płatności i intensywności ich wykorzystania. Dane pochodzą z najnowszych raportów banków centralnych, instytucji płatniczych oraz organizacji międzynarodowych.

Rycina 6

Poziom adopcji dominujących metod płatności w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich

Źródło: opracowanie własne na podstawie: European Central Bank. (2023). Payments statistics: first half of 2023. Banque de France. (2025). Payments statistics: Second half of 2024. UK Finance. (2024). UK Payment Markets Summary. July 2024. Narodowy Bank Polski. (2025). Informacja o kartach płatniczych: IV kwartał 2024 r Deutsche Bundesbank. (2024). P ayment behaviour in Germany in 2023/2024. Sveriges Riksbank. (2025). Payments report 2025. Banco de España. (2025). National analyses. National Payments Corporation of India. (2025). UPI product & monthly metrics. Business of Apps. (2025). Mobile payments app revenue and usage statistics. Federal Reserve System. (2023). Federal Reserve Payments Study (FRPS) 2022 & Diary of Consumer Payment Choice 2023. Banco Central do Brazil. (2025). Pix Statistics.

Dokonując analizy danych przedstawionych na rycinie 6, można stwierdzić, że w krajach europejskich dominują płatności kartowe, szczególnie w Polsce, Wielkiej Brytanii i Francji, gdzie udział kart przekracza 60-80%. Szwecja wyróżnia się zrównoważoną strukturą, z wysokim udziałem zarówno kart, jak i płatności mobilnych i natychmiastowych. Z kolei Chiny, Indie i Brazylia pokazują globalne przesunięcie w stronę płatności mobilnych i natychmiastowych (A2A) – dominują tam portfele cyfrowe i systemy typu UPI / PIX, które stanowią ponad 80-90% transakcji. Tendencja wskazuje na silne przyspieszenie adopcji metod bezgotówkowych poza Europą, napędzane przez ekosystemy mobilne. Na rycinie 7 przedstawiono dane dotyczące stopnia cyfryzacji płatności w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich.

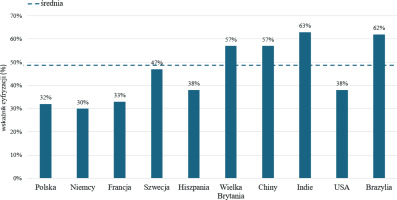

Rycina 7

Dane dotyczące stopnia cyfryzacji płatności w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich

Źródło: opracowanie własne na podstawie: European Central Bank. (2023). Payments statistics: first half of 2023. Banque de France. (2025). Payments statistics: Second half of 2024. UK Finance. (2024). UK Payment Markets Summary. July 2024. Narodowy Bank Polski. (2025). Informacja o kartach płatniczych: IV kwartał 2024 r Deutsche Bundesbank. (2024). Payment behaviour in Germany in 2023/2024. Sveriges Riksbank. (2025). Payments report 2025. Banco de España. (2025). National analyses. National Payments Corporation of India. (2025). UPI product & monthly metrics. Business of Apps. (2025). Mobile payments app revenue and usage statistics. Federal Reserve System. (2023). Federal Reserve Payments Study (FRPS) 2022 & Diary of Consumer Payment Choice 2023. Banco Central do Brazil. (2025). Pix Statistics.

Biorąc pod uwagę dane zawarte na rycinie 7, należy zauważyć, że najwyższy poziom cyfryzacji płatności odnotowują Chiny (90%), Indie (63%) i Szwecja (47%), co odzwierciedla ich zaawansowanie w integracji mobilnych i natychmiastowych rozwiązań. W krajach europejskich Wielka Brytania osiąga wynik powyżej średniej (ok. 56%), zaś Polska poniżej średniej (33%) podobnie jak Francja. Może to oznaczać szybki rozwój infrastruktury płatniczej i rosnącą akceptację płatności elektronicznych. Kraje o niższych wskaźnikach (np. Niemcy, Hiszpania) wciąż cechuje konserwatywne podejście i silna pozycja gotówki, choć trend ten stopniowo się odwraca. Na rycinie 8 przedstawiono stopień adopcji płatności natychmiastowych w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich.

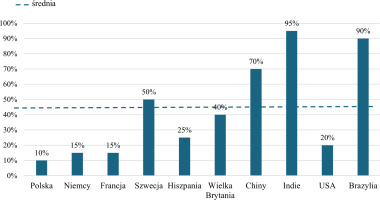

Rycina 8

Stopień adopcji płatności natychmiastowych w wybranych krajach Unii Europejskiej oraz w kilku kluczowych gospodarkach pozaeuropejskich

Źródło: opracowanie własne na podstawie: European Central Bank. (2023). Payments statistics: first half of 2023. Banque de France. (2025). Payments statistics: Second half of 2024. UK Finance. (2024). UK Payment Markets Summary. July 2024. Narodowy Bank Polski. (2025). Informacja o kartach płatniczych: IV kwartał 2024 r Deutsche Bundesbank. (2024). Payment behaviour in Germany in 2023/2024. Sveriges Riksbank. (2025). Payments report 2025. Banco de España. (2025). National analyses. National Payments Corporation of India. (2025). UPI product & monthly metrics. Business of Apps. (2025). Mobile payments app revenue and usage statistics. Federal Reserve System. (2023). Federal Reserve Payments Study (FRPS) 2022 & Diary of Consumer Payment Choice 2023. Banco Central do Brazil. (2025). Pix Statistics.

Rozpatrując dane zawarte na rycinie 8, można zauważyć, że największe rozpowszechnienie płatności natychmiastowych występuje w Indiach (95%), Brazylii (90%) i Chinach (70%), gdzie systemy UPI i PIX stały się podstawą nowoczesnych ekosystemów płatniczych. W Europie liderem jest Szwecja (50%), z silną pozycją systemu Swish. Pozostałe kraje UE (Polska, Niemcy, Francja, Hiszpania) mają umiarkowany poziom adopcji A2A, nieprzekraczający 30%. Może to oznaczać, że choć odpowiednia infrastruktura służąca dokonywaniu płatności natychmiastowych w Europie istnieje, jej pełne wykorzystanie dopiero się rozwija. W tabeli 5 przedstawiono zestawienie różnic regulacyjnych w obszarze płatności (ze szczególnym uwzględnieniem PSD2, nadchodzącego PSR oraz SCA) oraz ich wpływ na innowacje płatnicze w UE, Wielkiej Brytanii i wybranych gospodarkach pozaeuropejskich.

Tabela 5

Zestawienie różnic regulacyjnych w obszarze płatności oraz ich wpływ na innowacje płatnicze w UE, Wielkiej Brytanii i wybranych gospodarkach pozaeuropejskich

[i] Źródło: opracowanie własne na podstawie: Banco Central do Brazil. (2025). Pix Statistics. Capgemini. (2024). World payments report 2024. Consumer Financial Protection Bureau. (2024). Personal financial data rights rule (Open Banking proposal). Pobrane z: https://www.consumerfinance.gov (dostęp: 03.10.2025). European Banking Authority. (2022). Guidelines on strong customer authentication and common and secure communication under PSD2. European Commission. (2015). Directive (EU) 2015/2366 on payment services in the internal market (PSD2). European Commission. (2023). Proposal for a Regulation on payment services in the internal market (PSR). Financial Conduct Authority. (2023). UK open banking roadmap and smart data scheme framework. McKinsey & Company. (2024). Global payments in 2024: Simpler interfaces, complex reality. Organisation for Economic Co-operation and Development. (2022). Innovations in payment systems: Regulatory perspectives. People’s Bank of China. (2022). Administrative measures for non-bank payment institutions. PBOC. Reserve Bank of India. (2023). Unified payments interface (UPI) operational guidelines. RBI.

Transformacja współczesnych systemów finansowych w dużej mierze opiera się na innowacjach w obszarze płatności. Nowe sposoby inicjowania i autoryzacji transakcji, wykorzystanie otwartych interfejsów API oraz rozwój systemów płatności natychmiastowych są determinowane nie tylko przez postęp technologiczny, lecz również przez obowiązujące regulacje. Badania wskazują, że regulacje finansowe mogą jednocześnie stymulować rozwój innowacji, jak i tworzyć bariery ograniczające tempo ich wdrażania (Zetzsche i in., 2020).

W Unii Europejskiej dyrektywa PSD2 wraz ze standardami silnego uwierzytelniania (SCA) ustanowiły ramy funkcjonowania jednolitego rynku open banking. Ich implementacja jest dodatkowo wspierana przez przepisy dotyczące płatności natychmiastowych oraz planowane regulacje PSD3 / PSR. W innych jurysdykcjach przyjęto odmienne podejścia regulacyjne: w Stanach Zjednoczonych ochrona konsumenta opiera się na Regulation E, a zasady otwartego dostępu do danych dopiero się kształtują. W Chinach standaryzacja płatności mobilnych i przepisy dotyczące ochrony danych osobowych (PIPL) wzmocniły dominację cyfrowych portfeli. Natomiast Indie i Brazylia wprowadziły publicznie zarządzane systemy infrastrukturalne -odpowiednio UPI w Indiach oraz Pix w Brazylii – wspierane polityką zerowych opłat i regulacjami otwartych finansów (Arner i in., 2022). Tak zróżnicowane podejścia regulacyjne przekładają się na odmienne tempo i charakter innowacji płatniczych.

Ramy regulacyjne w poszczególnych krajach mają istotny wpływ na kierunek, tempo i formę rozwoju innowacji płatniczych. Regulacje sprzyjające otwartemu dostępowi do danych i niskim kosztom transakcji przyspieszają wdrażanie nowych metod płatności, natomiast przepisy skoncentrowane na bezpieczeństwie i ochronie konsumenta zwiększają zaufanie i masową adopcję. Skoordynowane podejście (jak w UE) równoważy bezpieczeństwo i innowacyjność, podczas gdy bardziej scentralizo-wane lub agresywnie promujące konkurencję systemy (Indie, Brazylia, Chiny) pozwalają na szybszą ekspansję i adaptację technologii płatniczych.

Efektem wprowadzenia regulacji może być rozwój open bankingu, pay-by-banku oraz portfeli cyfrowych, a także można wnioskować, że promują one innowacje, ale w kontrolowanym tempie. Wdrożenie regulacji PSD2 oraz wymogów SCA w Unii Europejskiej ma istotny wpływ na kształtowanie zaufania konsumentów do płatności cyfrowych. Zwiększona transparentność i bezpieczeń-stwo transakcji, wynikające z obowiązkowej silnej autoryzacji użytkownika, znacząco poprawiają postrzeganie wiarygodności dostawców usług płatniczych, zwłaszcza nowych podmiotów fintechowych. Jednocześnie faktem jest, że nadmierna złożoność procesów autoryzacyjnych w początkowym okresie reform ograniczała wygodę użytkowników i mogła hamować krótkoterminową adopcję e-walletów. W dłuższej perspektywie jednak PSD2 i SCA okazały się katalizatorem rozwoju otwartej bankowości w UE, zwiększając konkurencję i sprzyjając innowacjom w obszarze płatności mobil-nych i integracji API między bankami a fintechami (Beheri i in., 2023).

Różnice w implementacji ram regulacyjnych PSR w Unii Europejskiej oraz OBIE w Wielkiej Brytanii doprowadziły do zróżnicowanego tempa rozwoju ekosystemów otwartej bankowości. Należy zauważyć, że w UE proces wdrażania PSD2 i przyszłego PSR był silnie zorientowany na harmonizację i bezpieczeństwo, co zapewniło solidne podstawy prawne, lecz spowolniło komercjalizację nowych usług płatniczych. Z kolei Wielka Brytania, dzięki bardziej elastycznemu modelowi regulacyjnemu i silnej koordynacji w ramach OBIE, osiągnęła szybszy rozwój usług typu open API oraz Variable Recurring Payments (VRP). Podkreślić również trzeba, że pragmatyczne podejście regulacyjne oraz współpraca między sektorem publicznym a fintechami sprzyjają powstawaniu bardziej dynamicznych i konkurencyjnych ekosystemów płatniczych (Keller i in., 2024).

Szybki rozwój finansów cyfrowych jest napędzany przez nowe technologie, takie jak blockchain, stablecoiny, bankowość API i otwarte finanse. Ważne jest, że te innowacje zmieniają ekosystem finansowy, zwiększając wydajność, przejrzystość i dostępność, a jednocześnie wprowadzając nowe wyzwania regulacyjne (Kálmán, 2025). W tabeli 6 przedstawiono porównanie natychmiastowych systemów płatności w wybranych krajach w 2024 roku.

Tabela 6

Porównanie natychmiastowych systemów płatności w wybranych krajach w 2024 roku

[i] Źródło: opracowanie własne na podstawie: Banco Central do Brazil. (2025). Pix Statistics. BLIK. (2024). Raport roczny 2024:10 lat BLIKa. Polski Standard Płatności. Dutch Payments Association. (2024). Annual report 2024: iDEAL statistics. McKinsey & Company. (2024). Global payments in 2024: Simpler interfaces, complex reality. National Payments Corporation of India. (2025). UPI product & monthly metrics. Sveriges Riksbank. (2024). Payments report 2024. World Bank. (2024). Global payment systems survey (GPSS).

Podsumowując dane zawarte w tabeli 6, można stwierdzić, że BLIK ma tempo wzrostu porównywalne z liderami europejskimi (iDEAL, Swish) i jest jednym z najbardziej dynamicznych systemów w regionie UE. Systemy państwowe (Pix, UPI) osiągają nieporównywalnie większą skalę dzięki centralnemu wsparciu i obowiązkowej interoperacyjności. iDEAL i Swish pokazują, że silna integracja bankowa i prostota UX zapewniają trwałość modelu, podczas gdy BLIK wciąż znajduje się w fazie ekspansji funkcjonalnej.

Zakończenie

Proces cyfryzacji gospodarki oraz rosnące znaczenie e-commerce w Polsce i na świecie wskazują, że płatności cyfrowe stały się nieodłącznym elementem współczesnego handlu. Analiza polskiego rynku pokazuje dynamiczny wzrost wartości branży e-commerce, zwiększającą się liczbę użytkowników bankowości mobilnej oraz szybki rozwój nowoczesnych metod płatności, takich jak BLIK, pay-by-link czy portfele mobilne. Zmiany te nie tylko ułatwiają dokonywanie transakcji, ale również zwiększają ich bezpieczeństwo, szybkość i wygodę, co przekłada się na rosnącą popular-ność zakupów online wśród konsumentów w różnym wieku i z różnych lokalizacji. Porównanie globalnych rynków płatności cyfrowych pokazuje zróżnicowanie w tempie adopcji innowacji – od dominacji portfeli mobilnych w Chinach, przez szybkie płatności natychmiastowe w Indiach i Brazylii, po umiarkowane tempo rozwoju płatności natychmiastowych w Europie. Widać wyraźnie, że rozwój infrastruktury płatniczej oraz regulacje prawne, takie jak PSD2, SCA czy nadchodzący PSR, odgrywają kluczową rolę w kształtowaniu tempa i charakteru cyfryzacji płatności, zarówno w Polsce, jak i na świecie.

W perspektywie przyszłościowej można oczekiwać dalszej integracji płatności cyfrowych z handlem elektronicznym, w tym wykorzystania technologii biometrycznych, sztucznej inteligencji oraz spersonalizowanych rozwiązań płatniczych. Rozwój ten będzie sprzyjał nie tylko zwiększeniu komfortu i bezpieczeństwa konsumentów, ale także dalszej ekspansji branży e-commerce i umacnianiu cyfrowej gospodarki. Polska, inwestując w nowoczesne systemy płatności i infrastrukturę cyfrową, ma szansę stać się jednym z liderów innowacji w tej dziedzinie, co w dłuższej perspektywie może przyczynić się do zwiększenia konkurencyjności kraju na rynku międzynarodowym.